You’ve spent years mastering medicine. Now you’re ready to master business ownership. But before you hang your shingle, let’s talk about medical practice startup costs—because understanding the real financial investment shouldn’t lead to nightmares.

Medical practice startup costs in 2025 aren’t cheap, but they’re not as scary as some make them sound. The typical medical practice startup costs range from $70,000 for a simple family practice to over $525,000 for specialized surgical practices. The key is knowing where every dollar goes and which medical practice startup costs you can actually control.

Medical Practice Startup Costs: What You’re Actually Looking At

Based on analysis of over 3,400 healthcare businesses, here’s what different medical practice startup costs actually look like by practice type:

- Family/Internal Medicine: $152,000 – $285,000

- Physical Therapy Clinic: $171,000 – $320,000

- Specialty Practices: $250,000 – $450,000

- Surgical Practices: $400,000 – $525,000

- Medical Spa/Aesthetic: $450,000 – $650,000

These numbers aren’t designed to scare you—they’re your reality check for medical practice startup costs. Planning for the right amount means you won’t run out of cash six months in when patients are just starting to find you.

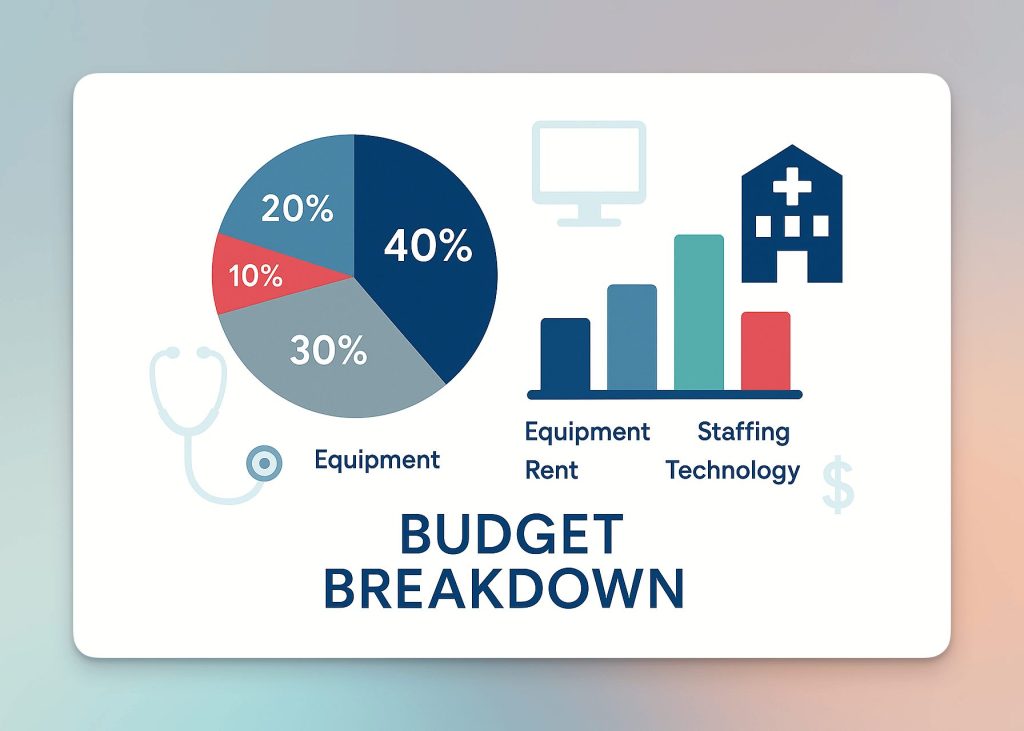

Essential Medical Practice Startup Costs Breakdown

Office Space and Setup: $25,000 – $100,000

Leasehold Improvements: $10,000 – $50,000 Your space needs to meet healthcare standards, not just look pretty. Smaller clinics can get by with $10,000 covering basic updates like flooring, painting, and lighting. Larger or premium spaces requiring custom treatment rooms, specialized plumbing, and upgraded HVAC systems can hit $50,000.

Monthly Rent Reality Check Rent becomes one of your biggest ongoing expenses. Budget $3,000-$15,000 monthly depending on location and size. Add utilities ($500-$2,000 monthly) for electricity, water, and high-speed internet.

Medical Equipment: The Big Investment

Essential Equipment: $50,000 – $150,000

- Basic diagnostic tools, exam tables, sterilization equipment: $50,000

- Advanced equipment (X-ray, ultrasound, specialty instruments): $150,000

Smart Equipment Strategy Keep individual purchases under $15,000 when starting out. Leasing makes sense for rapidly-changing technology like dermatology equipment. Look for gently used equipment—it can cut costs by 40-60% without sacrificing quality.

Technology Systems: $15,000 – $70,000

Your clinical documentation software and EHR systems aren’t just nice-to-haves—they’re essential for efficient operations and compliance.

Basic Technology Setup: $15,000

- Basic EHR software

- Billing systems

- Standard IT infrastructure

Advanced Setup: $70,000

- Comprehensive practice management software

- Advanced EHR with specialty features

- Integrated billing and scheduling systems

- High-end computers and networking equipment

Pro Tip: Consider Patient Notes AI at $59/month for unlimited clinical documentation. With a 7-day free trial and no credit card required, it’s an affordable way to handle one of your most time-consuming tasks while you establish cash flow.

Furniture and Office Setup: $5,000 – $20,000

Basic Setup: $5,000

- Essential furniture for exam rooms

- Basic reception area seating

- Storage solutions

Premium Setup: $20,000

- High-quality reception area furniture

- Comfortable patient waiting rooms

- Executive office furniture

- Additional storage and organization systems

Licensing, Insurance, and Legal: $10,000 – $25,000

Required Licenses and Permits

- Medical license applications and renewals

- DEA registration

- State-specific practice permits

- Business license and tax registrations

Insurance Coverage (Annual)

- Malpractice insurance: $3,000 – $50,000+ (varies by specialty)

- General liability: $500 – $2,000

- Property insurance: $800 – $3,000

- Workers’ compensation: Based on payroll

Legal Setup Costs

- Business formation (LLC/Corporation): $500 – $2,000

- Contract templates and legal review: $2,000 – $5,000

- Compliance consultation: $1,000 – $3,000

Marketing and Digital Presence: $5,000 – $15,000

Your website isn’t optional—it’s often patients’ first impression of your practice. Budget smartly here because a poor online presence costs more than a good one.

Essential Digital Setup: $5,000

- Professional website with online scheduling

- Basic branding (logo, business cards)

- Google My Business optimization

- Initial online advertising setup

Comprehensive Marketing: $15,000

- Custom website with patient portals

- Professional photography and branding

- SEO optimization and content creation

- Multi-channel advertising campaigns

For detailed strategies, check our complete guide on digital marketing for healthcare professionals.

Staffing Costs: The Ongoing Reality

Don’t forget about human resources—they’re your biggest ongoing expense.

Initial Staffing Budget (First 6 Months)

- Medical Assistant: $18,000 – $25,000 (6 months salary)

- Front Desk/Receptionist: $15,000 – $22,000

- Benefits (add 20-30% to salaries)

- Recruitment and training costs: $2,000 – $5,000

2025 Salary Trends According to MGMA data, medical practices are budgeting median increases of:

- Medical Assistants: 5.5% increase (expect $35,000-$45,000 annually)

- Front Desk Staff: 4.5% increase (expect $30,000-$40,000 annually)

- Registered Nurses: 5% increase (approaching $80,000 annually)

Medical Practice Startup Costs: Hidden Expenses That Bite

Insurance Credentialing: $2,000 – $8,000 Getting approved with insurance companies takes 3-6 months and often requires credentialing services. Budget for both the fees and the revenue gap during this period.

Working Capital for Cash Flow You need 3-6 months of operating expenses in the bank. Insurance payments are slow, and patient collections take time. This isn’t startup cost—it’s survival money.

Maintenance and Repairs: $500 – $2,000 Monthly Equipment breaks. HVAC needs service. Plumbing issues happen on Fridays. Set aside money for the inevitable.

Billing and Collections: 3-8% of Revenue Either hire internal staff or outsource to professionals. Complex insurance rules mean mistakes cost money, and delays in payment affect cash flow.

Medical Practice Startup Costs: Smart Cost-Cutting Strategies

Equipment Financing vs. Cash Leasing equipment preserves cash flow but costs more long-term. Buy used equipment when possible, but ensure it comes with warranties.

Shared Spaces and Services Consider sharing space with complementary practices. Split reception staff, utilities, and common areas to reduce overhead.

Technology Integration Choose software that handles multiple functions instead of separate systems for scheduling, billing, and documentation.

Phased Growth Start with essential services and equipment. Add specialties and advanced equipment as revenue grows.

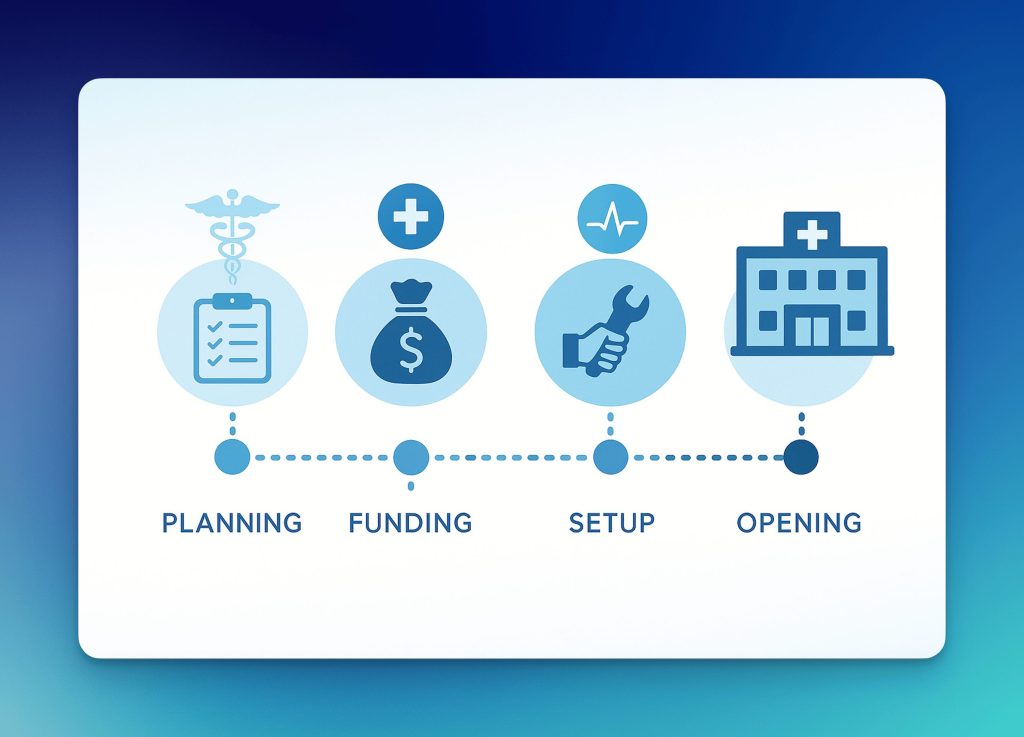

Financing Your Practice: Real Options

SBA Loans: Most Popular Choice

- Lower interest rates

- Longer repayment terms

- Requires detailed business plan

- Can cover up to 90% of startup costs

Equipment Financing

- Specific to medical equipment purchases

- Equipment serves as collateral

- Competitive rates for healthcare

- Quick approval process

Practice Purchase vs. Startup Buying an existing practice can cost more upfront but provides immediate cash flow and established patient base.

Specialty-Specific Considerations

Primary Care Practices Lower equipment costs but higher competition. Focus budget on location, marketing, and efficient operations systems.

Surgical Specialties High equipment and facility costs. Consider hospital partnerships or surgical center affiliations to reduce overhead.

Mental Health Practices Lower equipment needs but higher insurance complications. Budget extra for billing services and HIPAA-compliant systems.

Aesthetic/Cosmetic Practices High equipment costs but often cash-pay, improving cash flow. Marketing budget becomes more critical.

Revenue Expectations: When Do You Break Even?

Realistic Timeline

- Months 1-3: Building patient base, slow revenue

- Months 4-8: Revenue growth as word spreads

- Months 9-12: Approach break-even point

- Year 2+: Profitable operations

Revenue Benchmarks

- Small practices: $10,000-$50,000 monthly revenue

- Established practices: $50,000-$100,000 monthly revenue

- Profit margins typically range 10-30% once established

Self-employed physicians average $352,000 annually vs. $300,000 for hospital-employed physicians, making practice ownership financially attractive long-term.

The First-Year Operating Budget

Beyond startup costs, budget for first-year operations:

Monthly Operating Expenses:

- Rent and utilities: $3,500-$17,000

- Staff salaries and benefits: $8,000-$25,000

- Medical supplies: $500-$3,000

- Insurance premiums: $500-$4,000

- Software subscriptions: $500-$2,000

- Marketing: $1,000-$5,000

Total First-Year Operating: $165,000-$672,000

Making Your Decision

Understanding medical practice startup costs is expensive, but it’s not impossible. The key is realistic planning and understanding that success takes time.

Essential Questions to Answer:

- Do you have 3-6 months of operating expenses saved?

- Have you researched your local market and competition?

- Do you understand insurance credentialing timelines?

- Have you identified your financing sources?

- Do you have a realistic patient volume projection?

Red Flags to Avoid:

- Underestimating cash flow needs

- Buying the most expensive equipment first

- Skipping market research

- Not budgeting for marketing

- Choosing the wrong location to save money

Your Next Steps

- Create a detailed business plan with realistic financial projections

- Research your local market thoroughly—competition and patient needs

- Secure financing pre-approval before making commitments

- Start insurance credentialing early—it takes 3-6 months

- Choose efficient systems like Patient Notes AI to minimize administrative costs

The dream of practice ownership is achievable with proper planning. Focus on providing excellent patient care, control your costs, and be patient with growth. Most successful practices take 12-18 months to hit their stride, but the independence and potential returns make the investment worthwhile.

Remember: every successful practice started with someone asking “how much will this really cost?” You’ve taken the first step by seeking real numbers instead of wishful thinking. Now make it happen.